I know you didn’t hear from me the previous week. I was attending conferences, meetings and events — solidifying ClayStack’s position in the market. It was great to see so many people excited about the project. It also confirmed my doubt that liquid staking space is still at a nascent stage and needs a lot of attention and education.

Moving on, the Bitcoin futures ETFs have caught my attention lately.

It has been more than a week since the launch of the first Bitcoin Futures ETF (BITO) by ProShares. And, just a few days since the launch of the one by Valkyrie (BTF). Another one, being launched by VanEck, is said to hit the markets this week. And several other funds are in the pipeline, awaiting approval. The surging interest in ETFs signal two things.

- The SEC is embracing an indirect approach towards letting investors’ gain exposure to Bitcoin, mainly due to significant investor protections possible therein.

- The second is the arrival of investors (both institutional and retail) to a new financial product that hedges against the rising inflation.

Regardless of an incredibly successful launch, there are a few things that cannot be ignored.

- Rollover costs of the futures contracts,

- the fund’s potential inefficiency to track the price of Bitcoin futures and

- overall futility of a fund based on a derivative of bitcoin and not actual bitcoin itself.

In this week’s Magnify, I will fundamentally break down the funds to see what they look like and explore their role in the larger financial markets.

Let’s dive in.

ProShares — First to Market, First to Adoption

ProShares was the first to launch the ETF, which meant they could capture the larger market. The fund managed to amass over $1B in assets within two days of its launch. In fact, it managed to acquire about 1,900 contracts for October (and even acquired about 1,400 November contracts). The initial monthly limit, set by the Chicago Mercantile Exchange (CME), was 2,000 contracts. But, in light of the financial instrument’s popularity, they decided to raise the ceiling to 4,000 contracts per month.

A crucial point must be noted here. The Bitcoin futures ETF tracks the price of Bitcoin futures, not the spot price of Bitcoin. And in the case of ProShares, this is done by tracking the futures price on the CME. Thus, the capital benefits are accrued through “actively” managed exposure to Bitcoin. An expense ratio of 0.95% (the management fee) is being accrued on the investor.

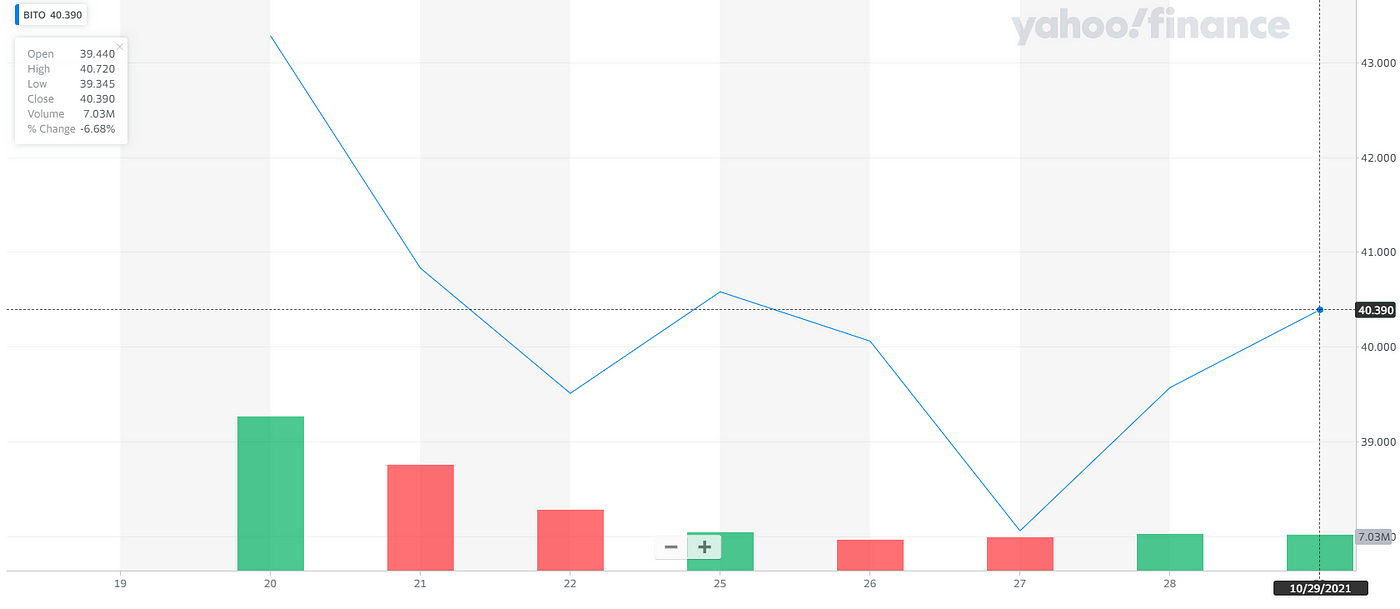

The trading on the fund has reduced in the past few days, however.

Valkyrie — Still Finding Ground

As the market literally went up to the moon (or seemed to get the famed moonshot), Valkyrie announced the launch of their ETF on Oct. 22. While it did have a strong start, it was unable to rattle as greatly the crypto markets as ProShares’ fund had.

It has only been a week since Valkyrie’s fund was launched, and a hurdle that has been posed in front of them is that of acquiring sales and liquidity from ProShares’ ETFs. While that may be true, I think it is too early to comment on who gets to tap into the larger market share.

Within a few hours of its launch, the share price fell to $24 from $25.52 (at its launch). It is currently trading at a volume of 3M shares, while the ProShares ETF fund trades with a whopping 11M.

VanEck’s Fund — Coming Soon

VanEck’s fund has been given the green light to launch as well, although it is delayed. The fund is set to launch with a management fee of 65 basis points (0.65%).

The Welcoming Cheer

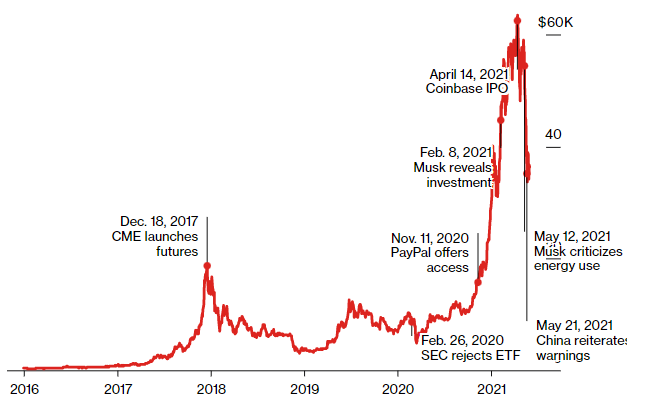

The sheer volume that BITO acquired within hours of its launch signals a red-carpet welcome by investors. And these aren’t the only ETFs. The SEC is already reviewing about two dozen ETF filings for bitcoin and bitcoin futures. Chairman Gary Gensler indicated that he is open to accepting proposals on Bitcoin futures and would enforce the same rules that mutual funds follow.

For many investors, this is their only shot at getting exposure to Bitcoin especially when traditional brokerages don’t offer the option to buy actual Bitcoin. But the evolving landscape and rising popularity also create problems for the investors.

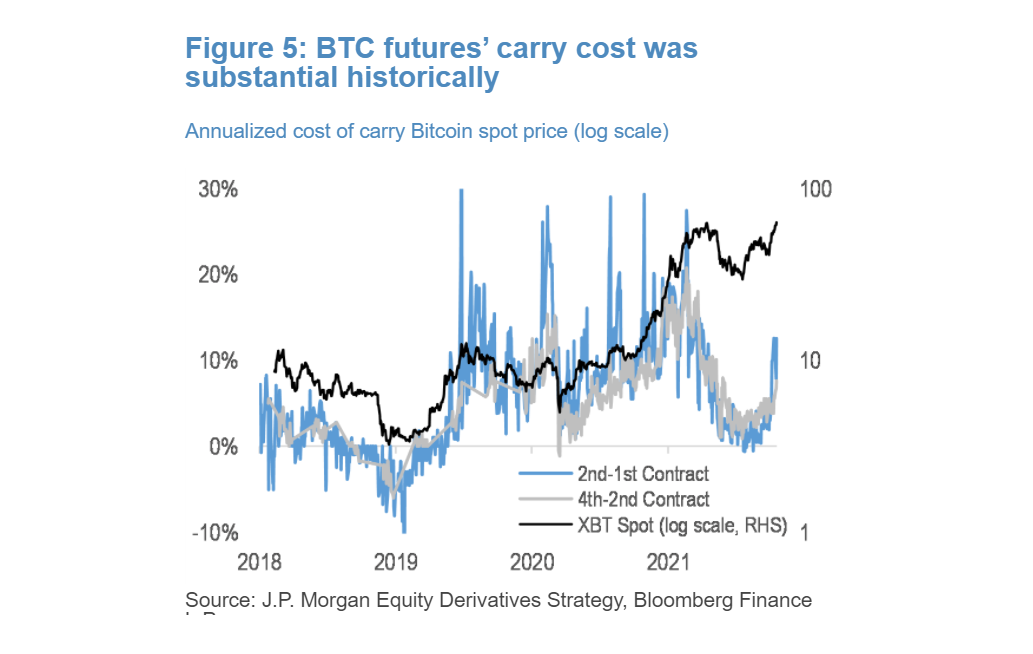

The increasing demand for the financial instrument portends a potentially distorted futures market, which could further increase the investors’ costs in the future. The centre of this problem lies in the costs of rolling over futures contracts to subsequent months.

The more the investors long their position on the ETF, the more costs they will accrue, and this problem will be amplified by the growing number of investors who are buying the shares of the fund.

Against the Background of Inflation

There is no doubt that against the backdrop of inflation and rising prices, most investors are looking for alternative ways to hedge. Crypto comes in as the favored kid with the “SEC-approved” hat on its head. Add to that the wider adoption of crypto through this year. Many investors already had their eyes set on this asset class.

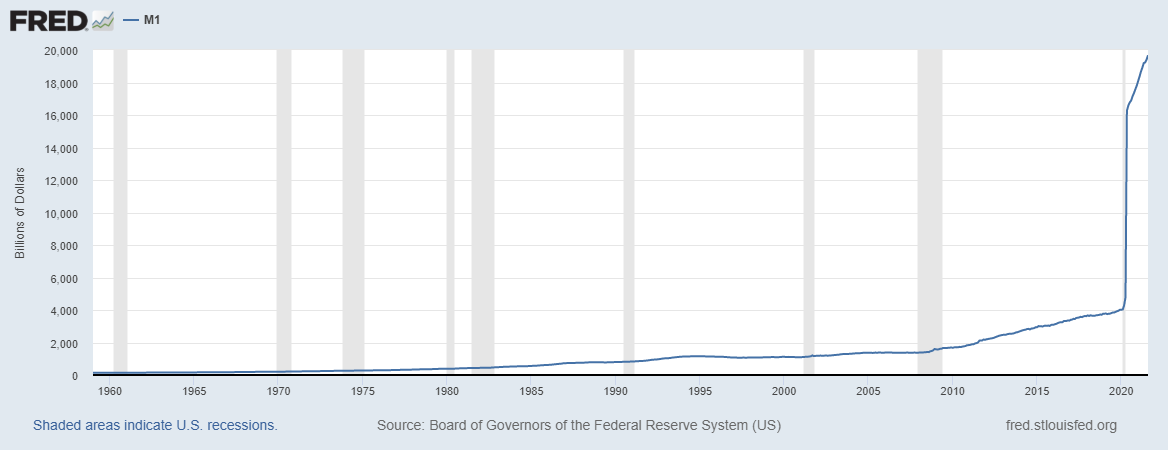

The rising Consumer Price Index (CPI) rates (which has already risen by 5.4% since the previous year, as reported by the FRED) fueled by the supply crisis has been upsetting to the larger economy.

- The central banks across the US, Europe and Japan have spent about $9T in buying various government bonds in an attempt to stimulate the overall economy.

- The Japanese central bank has been lending more so that businesses can still survive. But this stimulus spree is certainly not helpful everywhere.

- Just look at the amount of US dollars that have been pumped into the economy.

This looks more like demand-pull inflation to me, given the pandemic-induced supply crunch was worsened by the Ever Given just a few months ago. This is why the talks of tapering have been so prevalent in the US.

Thus the rising inflation has left us with two options.

- The first is for the government to increase the interest rates to reduce borrowing and thereby balance out the economy.

- On the other hand, for the investor, they can find better ways to hedge their money at a time when its value is going down.

A regulator-approved financial product is certainly an alternative they can rely on.

What Lies Ahead

The Bitcoin futures ETF landscape is ballooning with various asset managers and funds like Bitwise Asset Management and BlockFi Inc. already having submitted their application for a custom futures ETF.

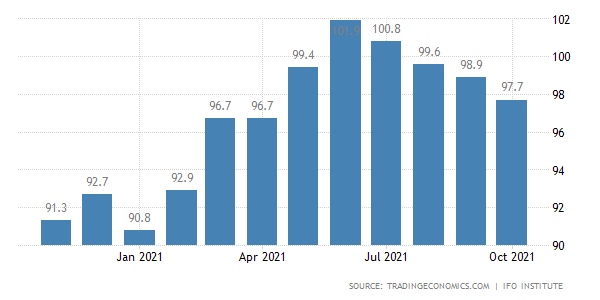

The rising risks of inflation are palpable not only in households but also amongst entrepreneurs. The reducing German Business Climate Index shows how entrepreneurs overall vigor to drive businesses is taking a hit.

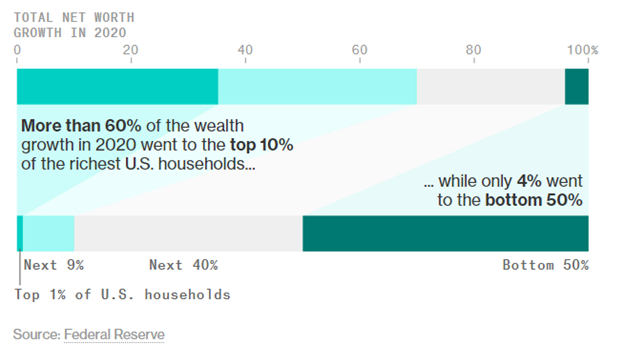

It is certainly hard to put a blame on an entity. Central banks provided stimulus when it was most needed (during the pandemic). The tapering could have been done earlier. The supply chains could have been fixed. The truth is that central banks have the liberty to print money when “needed”. A statistic states that about 8% of American adults have “enough assets” to fit the definition of a millionaire. Does that mean that by just printing more money we are easily producing more millionaires? What about the value of what that money can do?

But we cannot escape the fact that most investors (both retail and institutional) can leverage this new asset class. The SEC’s decision to approve a futures ETF of Bitcoin is a crucial decision for the entire industry. But, it should be taken with a grain of salt. They recently rejected a perpetually leveraged Bitcoin ETF (the application for which was recently withdrawn by Valkyrie). Thus, while the regulatory authority is certainly showing signs of getting into the space gradually, it is approaching it exceedingly carefully. There are already 40 Bitcoin ETFs that are still awaiting approval.

Like the above article 👆, I uncover one intricate topic each week and share my findings. I’m @mohakagr on Twitter.

Subscribe to the newsletter and get weekly insights straight to your inbox. Get it here.