Polygon Network (previously Matic) has been the talk of the town. An increase in blockchain adoption, growing hype around DeFi, Google’s BigQuery announcement, and Mark Cuban’s investment are some of the highlights. The 4-year-old blockchain is finally getting the attention it deserves and is shaping up to be the scaling solution of choice.

The move from Matic to Polygon

Matic was one of the first projects to do an IEO on Binance Launchpad in April 2019 and introduced their mainnet in mid-2020. The platform featured a plasma chain (a side chain running parallel to the Ethereum Network) and PoS staking to optimize scalability and decentralization.

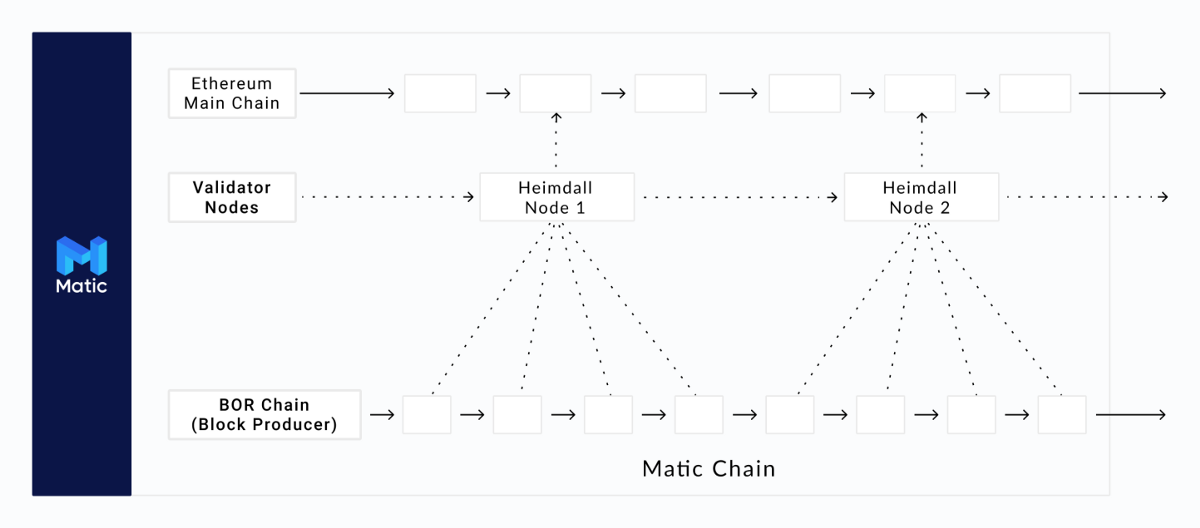

The plasma chain (Bor Layer) has 100 validators in an optimal scenario. Validators submit snapshots to the second plasma chain (Heimdall layer) before moving to Ethereum. As a result, the PoS chain is EVM compatible and allows Ethereum projects to migrate their smart contracts and scale the Ethereum network.

Polygon Network: Ethereum’s internet of blockchains

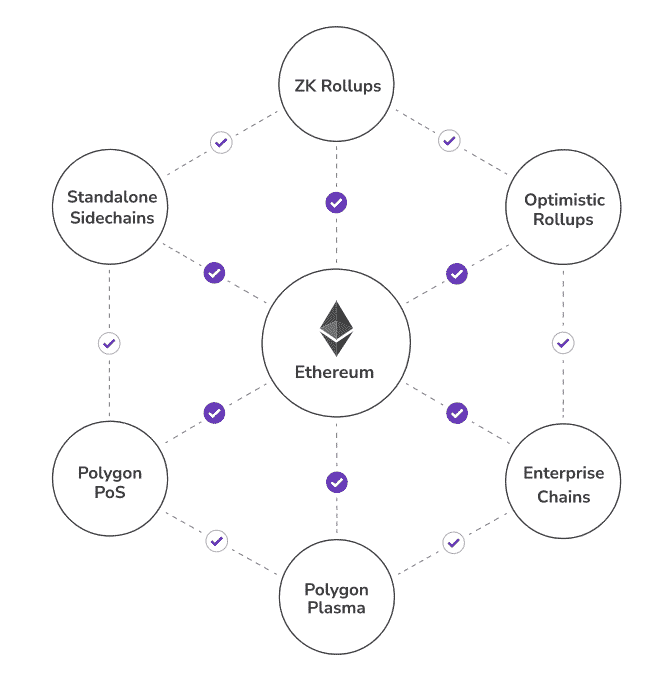

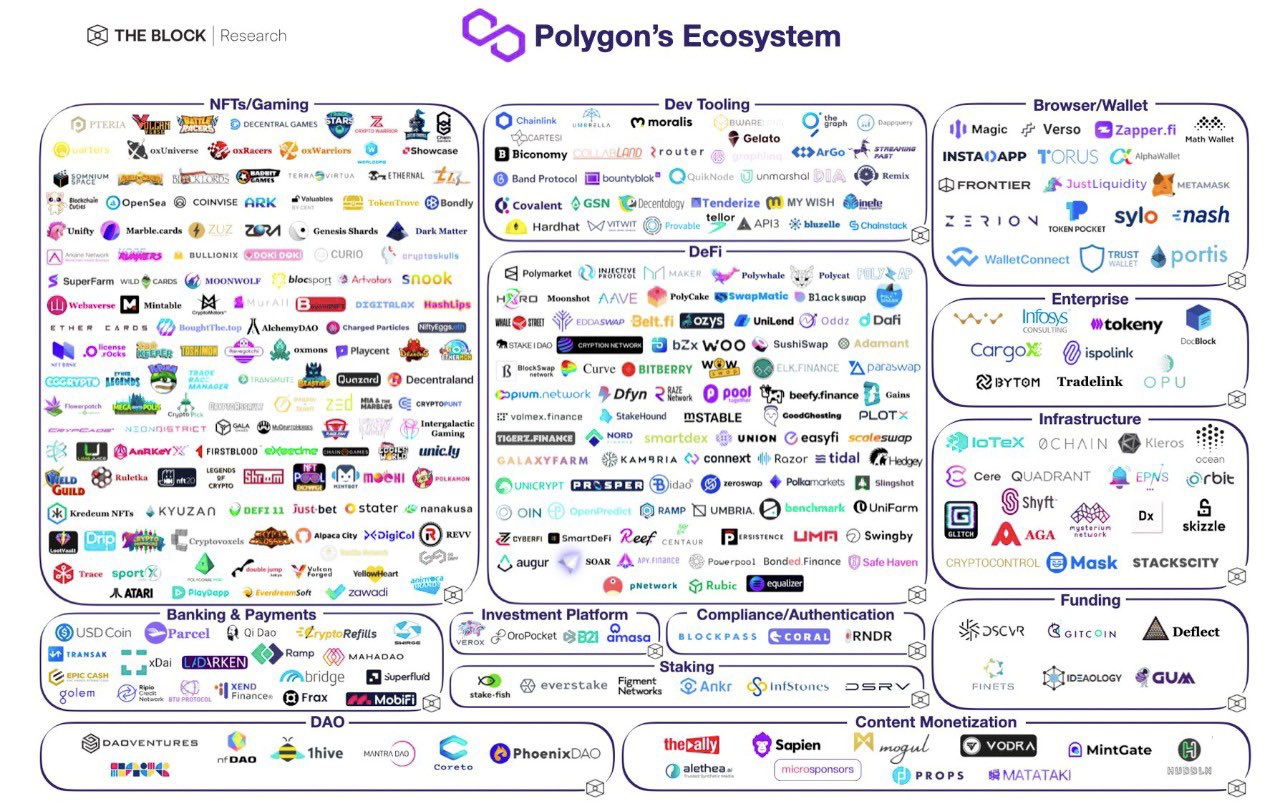

Polygon is a relatively comprehensive solution designed to launch interoperable blockchains while enhancing security and scalability. Furthermore, it creates an ecosystem that allows for connecting multiple scaling solutions and communicating with each other. According to Polygon, the future of ETH scaling is not one path but a hybrid solution.

The network supports two types of Ethereum compatible blockchain networks:

- Secured networks: Highly secure networks maintained by Polygon or Ethereum validators. Lacks flexibility.

- Standalone networks: Projects responsible for their security have their own pool of validators. Extraordinarily flexible but may have lower security standards.

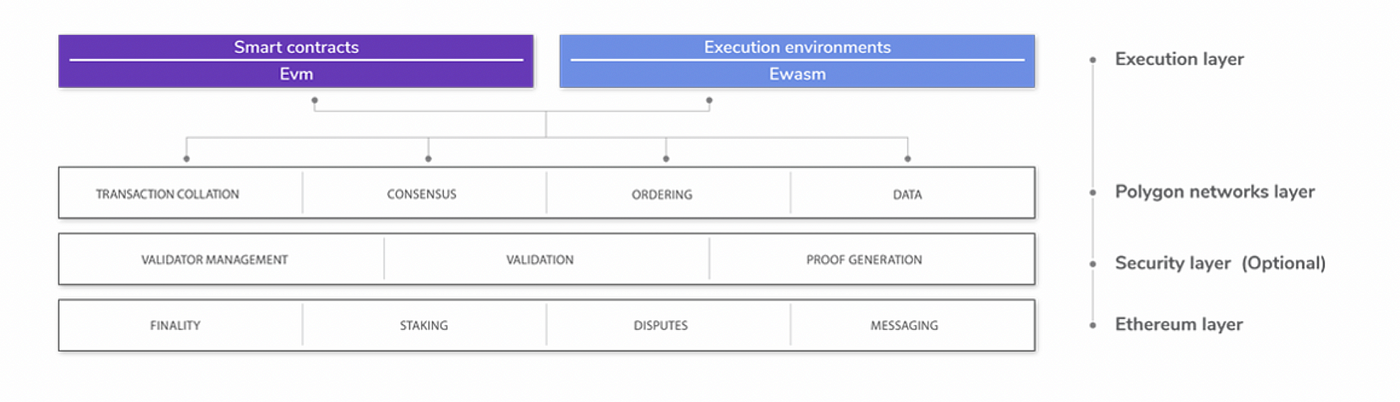

Additionally, the network architecture consists of 4 layers:

- Ethereum layer — An optional layer consisting of smart contracts built on the Ethereum blockchain. These smart contracts are responsible for handling finality, staking, and interchain communication. (Projects with high TVL may include this layer for additional security)

- Security layer — This runs parallel to the Ethereum network and acts as a validator as a service to provide additional security for a fee. (An application that wants lower fees can opt-out)

- Polygon network layer — The base layer of the network with a collection of sovereign blockchain networks that serve each other. It is a mandatory layer ideal for applications with their own set of validators and wishes to use the Polygon network.

- Execution layer — A mandatory layer needed to execute smart contracts. It is EVM compatible and allows for Ethereum based applications to run on the network.

Projects are free to opt for the scaling solution that fits their needs and optimize for security, transaction costs, speed. The aim is to create a hub that blockchains can easily plug into and overcome existing limitations.

Polygon network focuses on the Ethereum ecosystem and has successfully garnered traction from the largest dev community in the world.

Rise of DeFi on Polygon

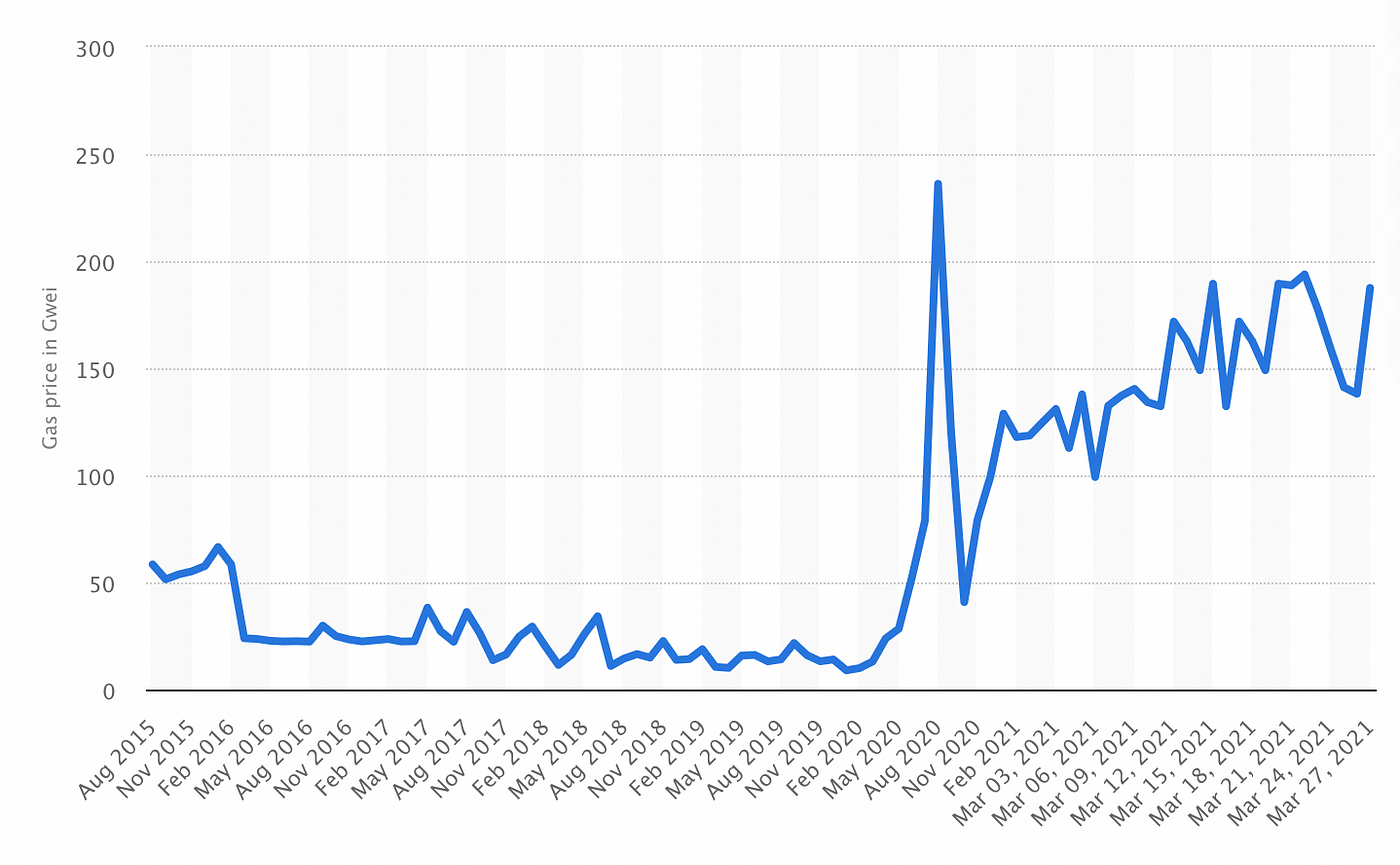

2021 has seen an influx of new users into the DeFi ecosystem from developing countries like India and Indonesia. While this is good for DeFi, Ethereum has struggled to keep up with the transaction volumes, and due to its clogged network, users had to pay high transaction fees.

Layer 1’s like Binance Smart Chain emerged as short-term options with support from some Ethereum DeFi applications and native copycats offering cheap transaction fees and high APR farms. However, a series of hacks on the network coupled with BNBs’ descending price action has led to a decline in users and paved the way for Polygon Network.

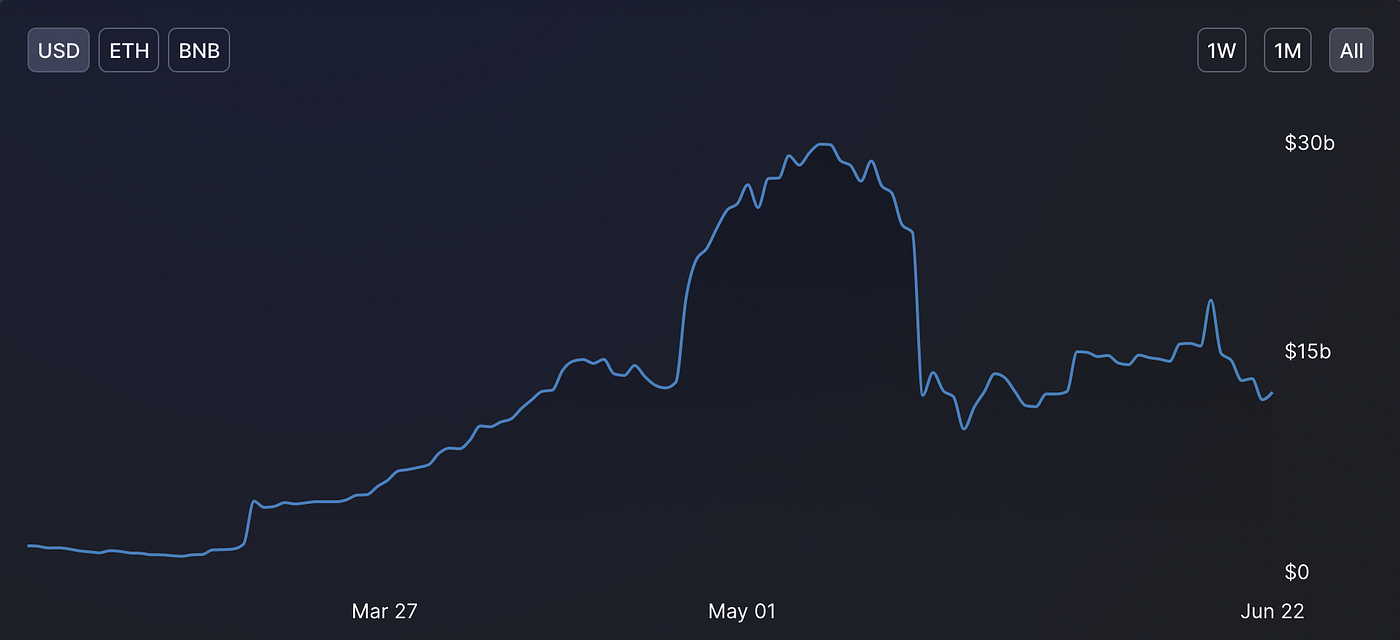

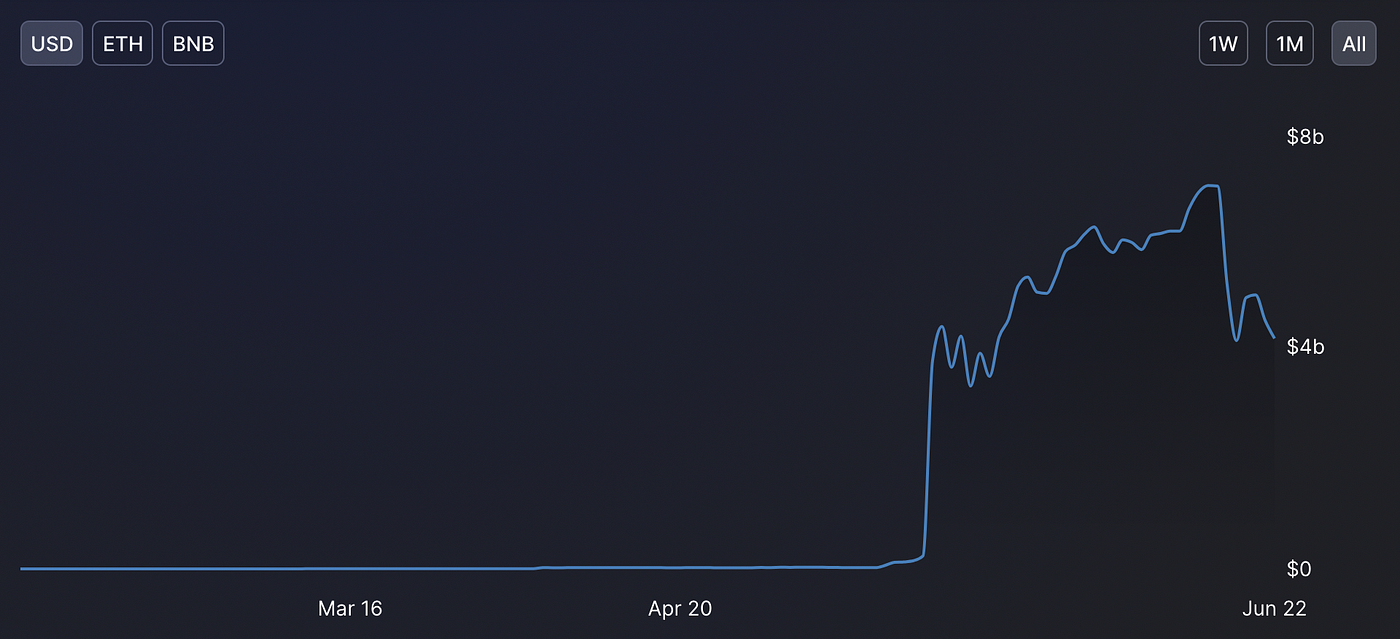

Since May, major DeFi protocols like AAVE, SushiSwap, Curve, among others, have moved to Polygon and are garnering high traction while keeping the users safe. The migration of users from the Ethereum network to Polygon is rapidly increasing and has relieved the clogged Ethereum network. This clearly shows that users are unwilling to pay high transaction costs and wait for extended amounts of time to achieve finality.

To put things in perspective, here are a few facts.

1/ Month/month, $MATIC increased active users by 86.12% and revenue by 70.45%.

— Raphael (@RaphaelSignal) June 16, 2021

In same time period $ETH dau fell -17.80% and revenue collapsed -85.10%.

Today we expand our analysis on @0xPolygon, introducing rev metrics for the first time, and continue user and tx study 👇👇 pic.twitter.com/boe4XBeTpx

To top it all, Polygon has several native applications that are leveraging the best of the network and catering to some interesting use cases.

Exploring new frontiers

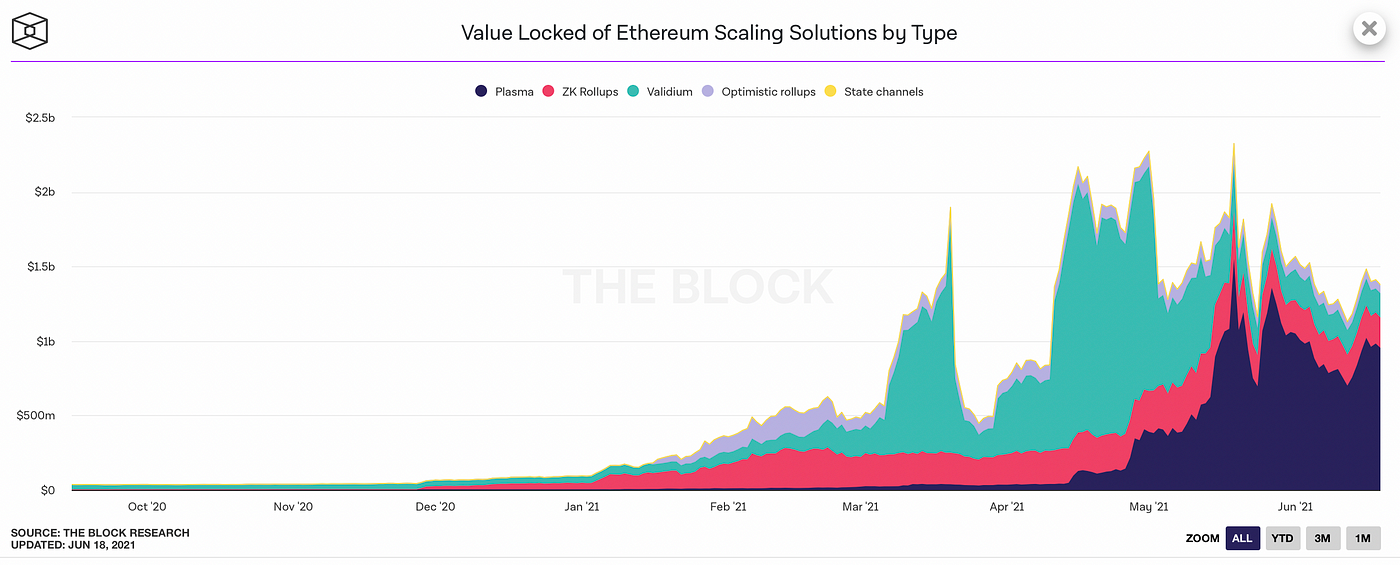

The network is currently exploring more prominent scaling solutions like Optimistic rollups and ZK rollups. These will help bundle a large number of transactions and make the network faster, cheaper, and more secure.

Earlier this month, research was released by the team discussing their findings and the way forward.

1/11 Polygon aims to become the go-to scaling hub, and we're actively exploring major scaling solutions.

— Polygon | $MATIC 💜 (@0xPolygon) June 15, 2021

In parallel, we want to educate the community; understanding different solutions & their trade-offs are critical.

Today we talk about Rollups.https://t.co/WiJCT9yoYG pic.twitter.com/dc6zcE6dHE

Competition and the way forward

While Polygon has got a head start, the L2 race is just getting started. With products like Loopring, OMG, zksync garnering users and building their own DeFi ecosystems, all may not be a hunky-dory for Polygon. Another threat is the advent of Optimism and Arbitrum and the hunger in the DeFi protocols to integrate them.

With ETH 2.0 not so far away, many assume that L2 solutions will go out of the limelight, but experts believe that ETH 2.0 and L2 will complement each other.

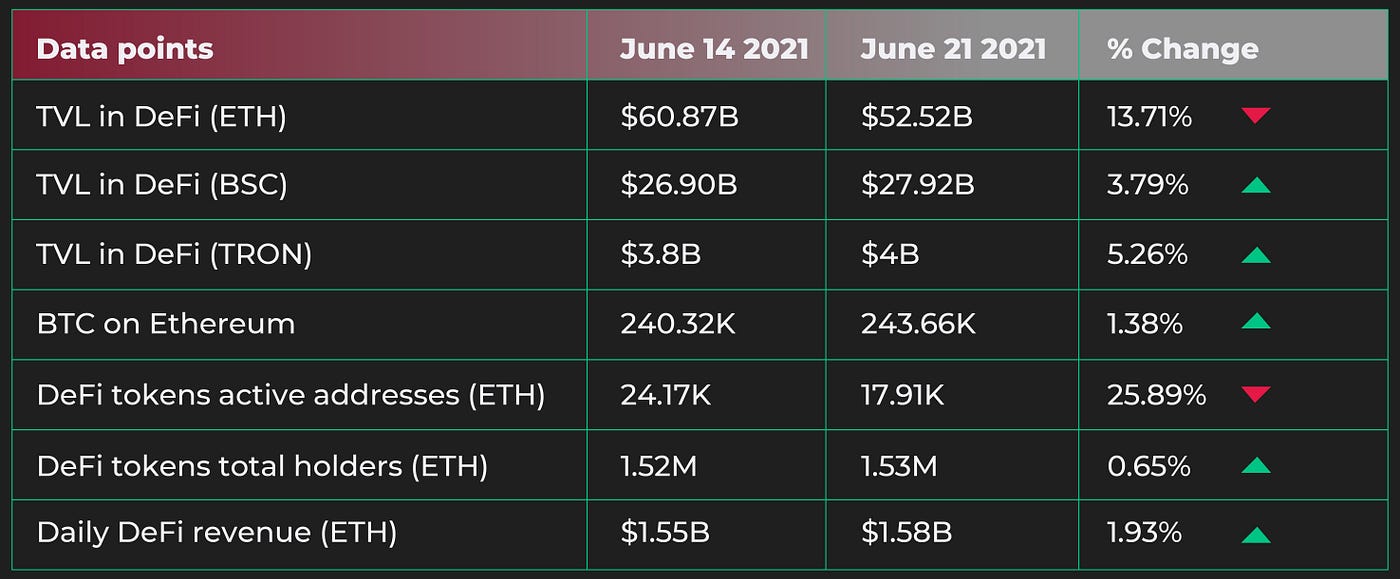

DeFi stats:

Top DeFi updates

Mirror Protocol V2 Testnet is live

V1 of Mirror protocol was a proof of concept to showcase that real assets can be traded on the blockchain. V2 builds on top of V1 and brings additional features, including new asset types, incentivizing community governance, and enabling users to diversity risks. The protocol aims to unlock the full power of asset tokenization and democratize access to financial assets.

Iron Finance releases post mortem

What appears to be the first crypto bank run, a rare situation where a large percentage of users attempt to withdraw their money simultaneously, crashed the token price to near $0 from its ATH of $65. Despite the setback, the team will continue to build products for the DeFi users.

Near Protocol releases treasury DAO proposal

Illia Polosukhin, CEO of Near Protocol, floated a proposal to establish an Ecosystem Treasury DAO with up to 200M $NEAR in funding. The proposal also included steps for member selection and possible types of allocations. As a next step, the community will share their feedback on the proposal. If no concerns are raised, the proposal will be launched to the voting for the initial members of the DAO.

DeFi Dose: Decentralized Autonomous Organizations (DAOs)

A DAO can function autonomously without a central party and is governed entirely by the community through smart contracts. DAO’s have significantly evolved over the years and are now a critical component of decentralized applications. They tackle the “principal-agent” problem, which is a regular instance in centralized/hierarchical organizations where the “agent” is in charge of making decisions for the “principal” and, in several cases, can harm the principal.

About ClayStack:

ClayStack is a decentralized liquid staking protocol that enables you to earn staking rewards while keeping your assets liquid. Without any lockups.

Get the latest updates!

Learn more about ClayStack, interact with our team, engage in community discussions, and share your valuable feedback.

- Telegram: https://t.me/claystack

- Twitter: https://twitter.com/ClayStack_HQ

- Website: https://claystack.com/

- Announcements: https://t.me/claystackchannel

- Alpha testnet: https://claystack.com/contact/alpha_tester