Polkadot and Kusama ecosystem

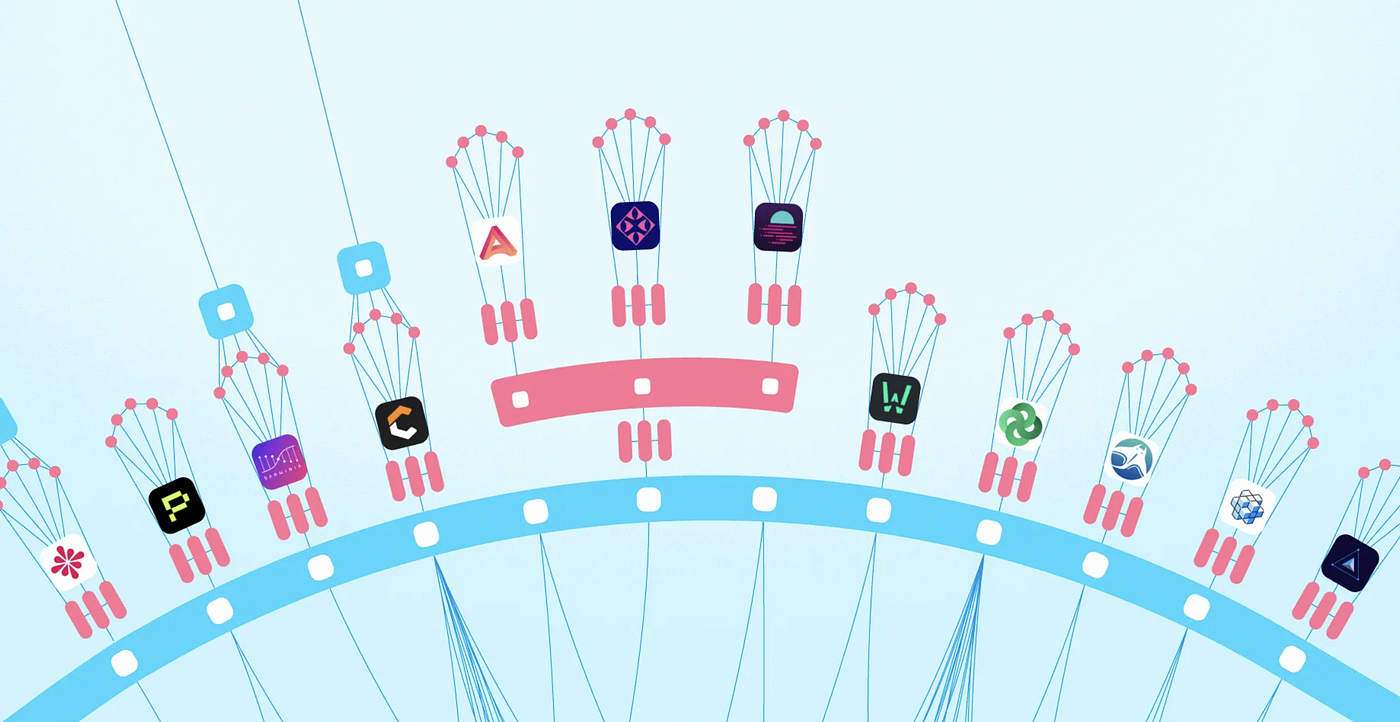

Polkadot, in its full functionality, wants to be a blockchain of blockchains. A Layer 0 skeleton that can connect with Layer 1 chains and their applications directly through parachains. The Relay chain is the core of Polkadot that communicates with the system as a whole and supports governance, staking (NPoS), and parachain auctions.

Kusama, on the other, is based on a similar code but has a standalone network and is created for experimentation and early-stage development. It has lower barriers to entry, the latest technology, and faster iterations; hence, chaos is expected. Considering Kusama to be a testnet for Polkadot is a wild mistake.

An overview of parachains

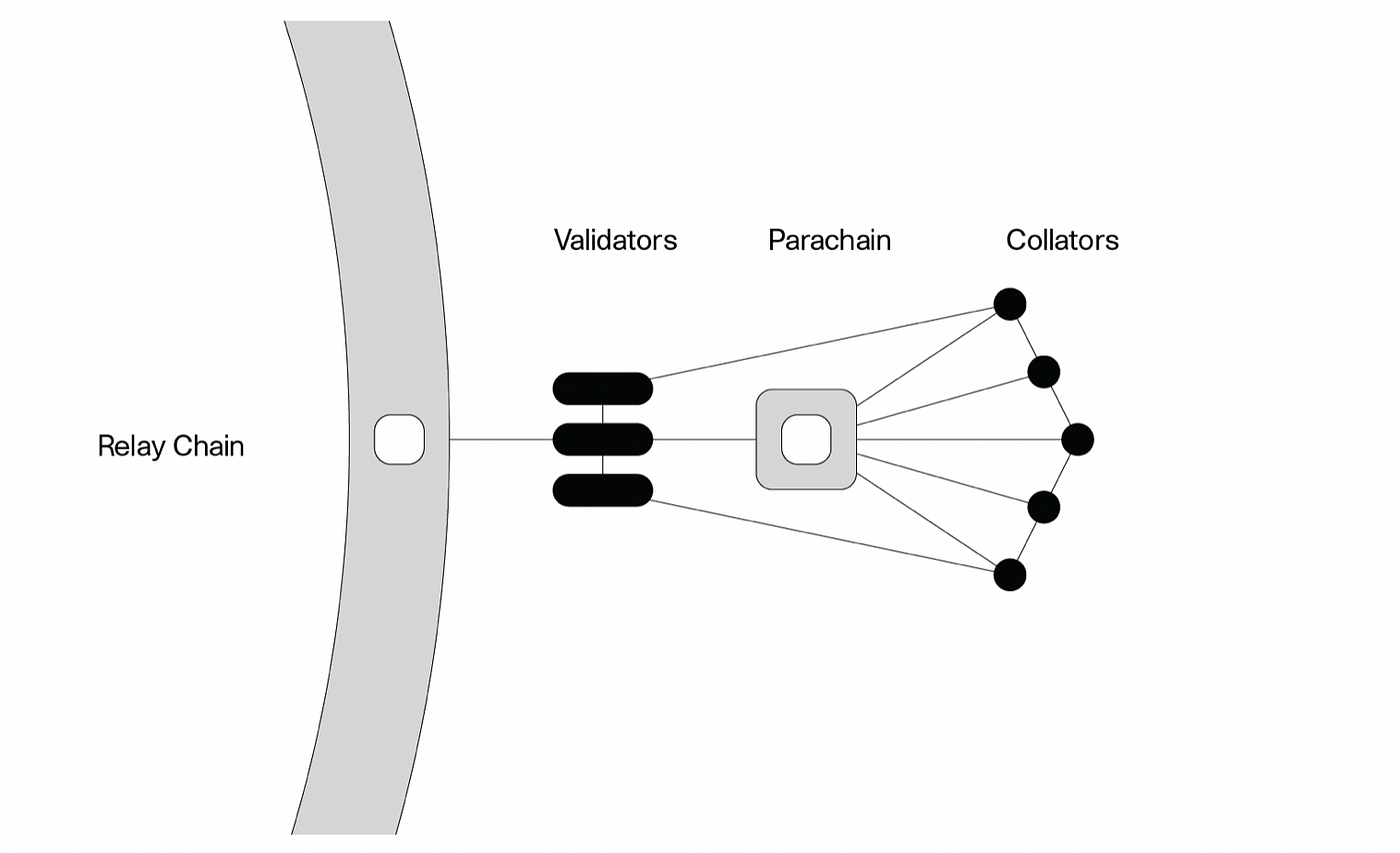

A Parachain is a blockchain that sits on top of the relay chain. It can process transactions and data parallel to the relay chain, share the network’s security (validators), and is truly interoperable with other parachains through Cross-chain Message Passing (XCMP). Collators are incentivized in DOT to maintain the parachain network and the necessary information. Parachains need not have their own token.

Kusama and Polkadot support a limited number of parachains (currently 100), and the slots are allocated bases on:

- Parachain auction — Bidding of slots based on the amount of DOT or KSM staked.

- Common good parachains — Governance allocations to chains that are good for the larger network. No need to stake DOT or KSM.

- Parathreads — Parachains that did not win or participate in the auction but want to access the slots on a pay-as-you-go basis.

Currently, the rollout for parachains on rococo testnet is successful, and the Kusama parachain auction is underway, followed by Polkadot parachain auction in Q3 2021.

Kusama parachain auction mechanism

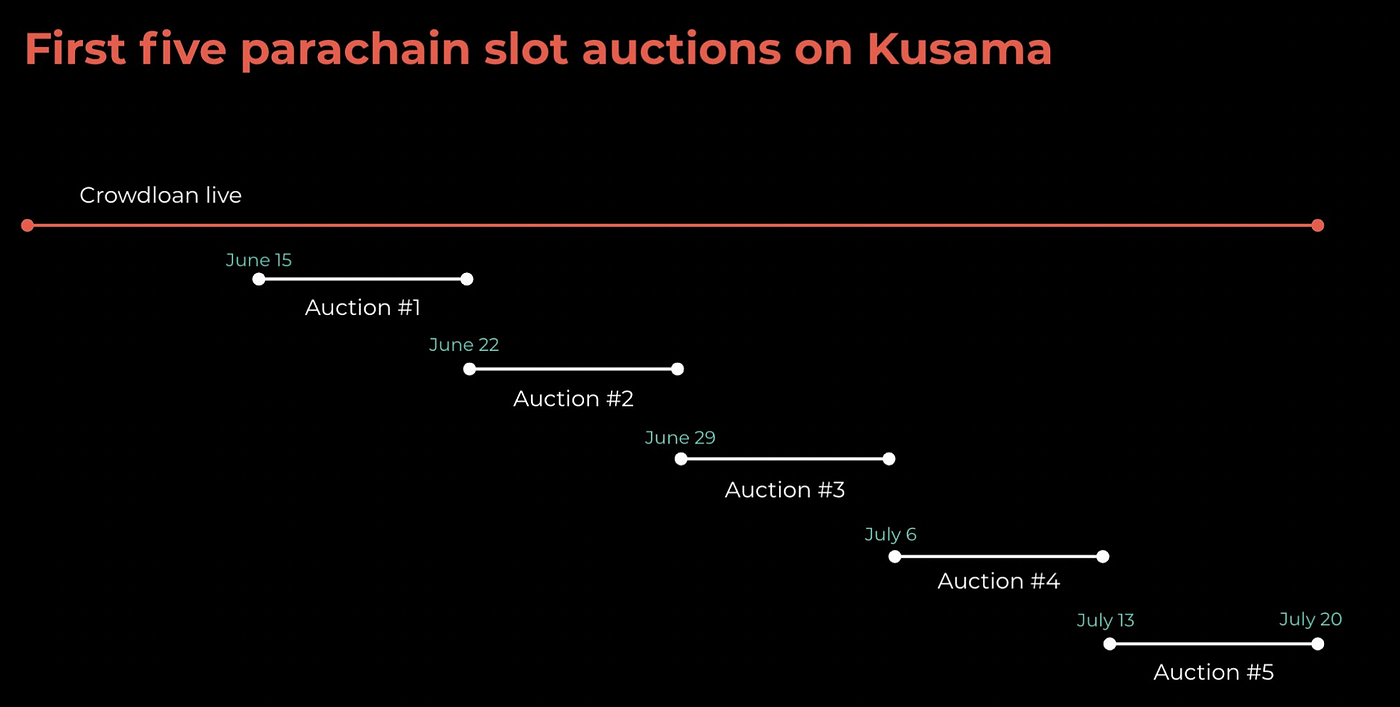

Earlier this week, the Polkadot governance proposed and enabled the onboarding of the first parachain auction. The network will support the auction for five parachains running till the end of July. It will act as a proving ground to observe the auction and the community network effects.

Parachain auctions follow a modified candle auction format. A popular auction mechanism in the 16th century where the auction would open with the start of the candle and end once the flame extinguished. Candle auction ensures that no one knows the exact time the auction will end.

The first parachain auction will run for approximately one week (the current one from June 15 to June 22, 2021). The first 1 day and 21 hours (2 days ) is the open period to garner the highest bids, followed by the next 5 days (ending period). The network then utilizes a Virtual Random Function (VRF) to determine the end of the auction, which can be before the actual known time to avoid last-minute bids.

The Kusama network will grant a slot to the winning chains on a lease of 1 year. The parachain enters the retirement phase at the end of the lease, and the initial stake is returned to the participants if they do not wish to participate further. Due to the permissionless nature of the protocol, projects can purchase a parachain slot from secondary markets.

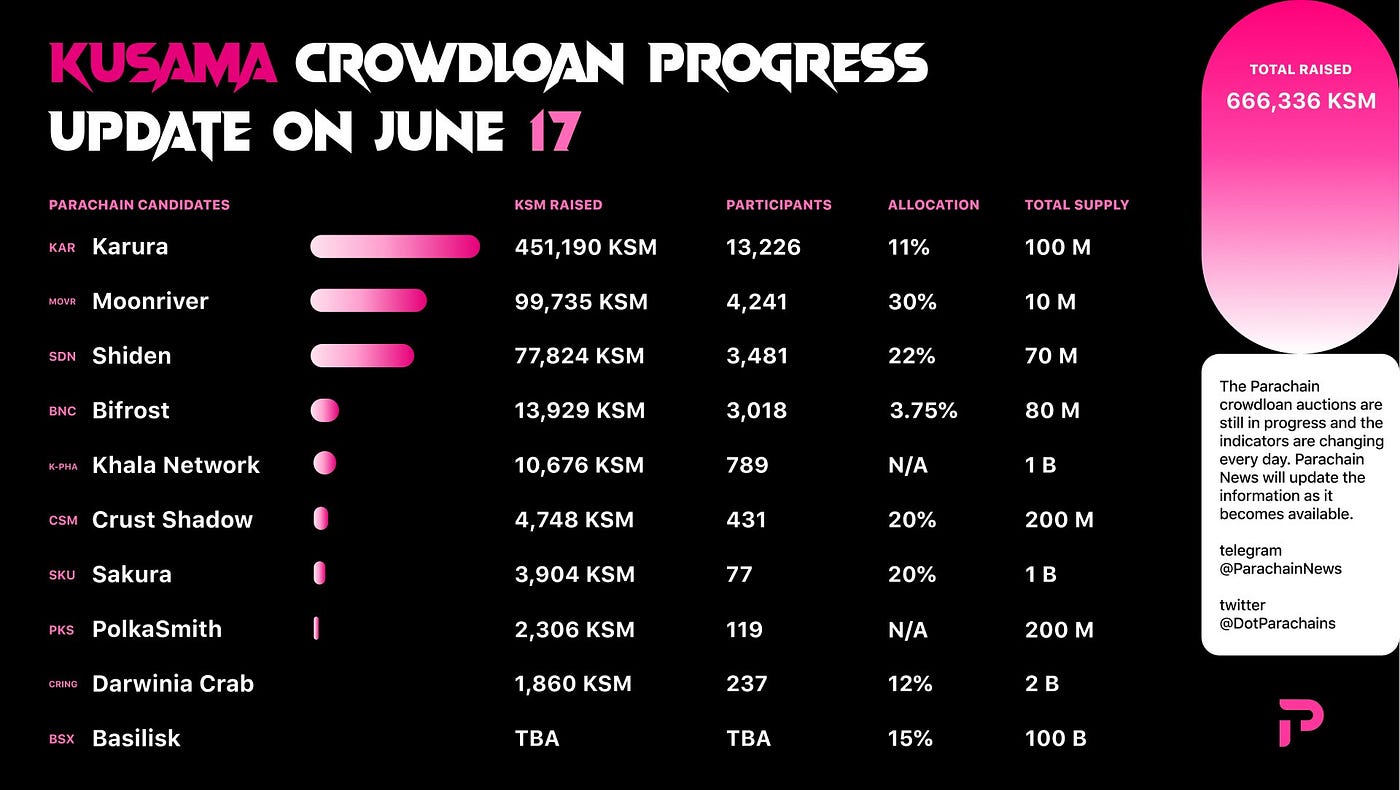

Parachain funding and crowdloans

While some teams may choose to fund the slot out of their pockets, several projects opt for crowdfunding by engaging the community and allowing them to stake KSM.

Such projects leverage Kusama’s native crowdloan mechanism, which works as follows:

- The team creates a crowdloan campaign with details on the number of contributors and duration.

- Crowdloan contributors initiate a unique transaction allocating KSM to the campaign.

- KSM contributions get locked during the campaign

- If the team wins the auction, staked KSM stays locked until the end of the lease.

- If the team loses the auction, contributors get the KSM at the end of the auction.

Many confuse crowdloans with ICOs (2017 boom that ended badly), but these are fundamentally different as the contributors are merely lending the KSM and get them back based on the auction. If the project wins the auction, contributors may also gain airdrop tokens with a huge upside. Several exchanges, including Kraken, Kucoin, and Hotbit, have supported the parachain auctions for their users.

Polkadot’s full functionality

Parachain auction is the last piece in the rollout plan to active a scalable multichain architecture. Polkadot’s auction will be similar to Kusama’s, with a difference in the slot lease duration (2 years for Polkadot vs 1 year in Kusama).

Once the parachain auctions conclude, features like XCMP, SPREE, and Parathreads will unlock additional avenues for projects to communicate with each other and with external blockchains, bringing healthy competition in the already heated smart contracts space.

Comparison with ETH

Ethereum Network is the base layer for smart contracts platform with the highest applications and value locked. As ETH 2.0 is still in development, several players, including Polygon, BSC, and Solana, are eating up market share (TVL) from Ethereum due to scalability issues. The introduction of a functioning Polkadot ecosystem with higher throughput and cheaper fees will further introduce serious consequences.

On the other side, Polkadot also has its concerns. Limited validators (only 240 — lower than Ethereum, Solana, and Cardano) and an unproven framework.

A multichain ecosystem

2020–21 has seen a tremendous acceleration in blockchain development. Decentralized applications are built on several blockchains and are eating up traditional finance. Polkadot may bring in a paradigm shift in blockchain interoperability and will surely heat up the ecosystem wars.

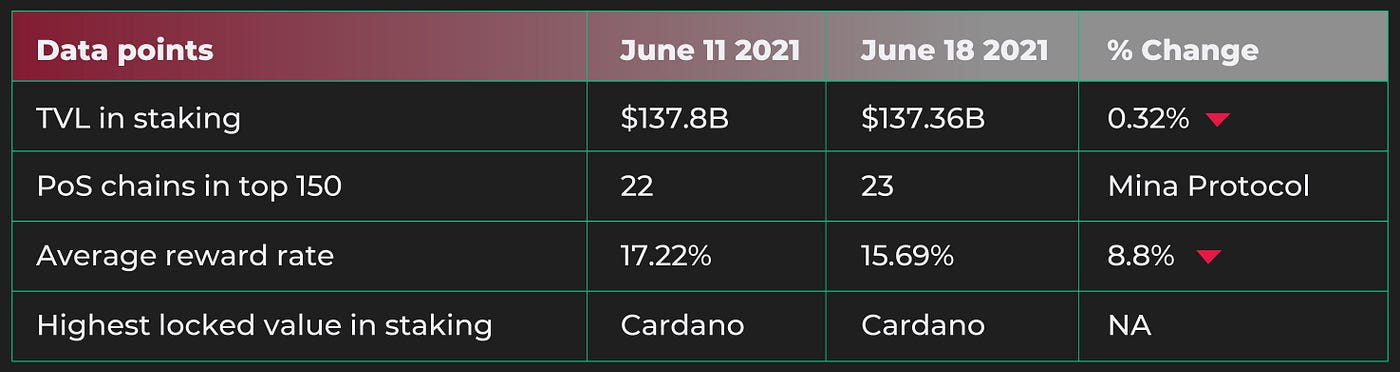

Staking economy stats:

Top headlines from PoS world:

AlonzoBlue 2.0 — The road to Alonzo

The newest version of the Cardano node comes with a CLI upgrade providing foundations for smart contracts applications. SPOs are requested to upgrade the node and then perform testing smart transactions.

Ethereum EIP1559 Testnet on June 24th

The fee-burning Ethereum upgrade, EIP 1559, is set to have its first testnet block on Ropsten testnet at block 10499401. A week after the testnet, the Proof of Authority (PoA) Goerli testnet is to be forked at block 5062605, followed by a fork of Rinkeby on July 7. The mainnet block will be chosen after smooth testnet forking and will require a client upgrade.

Eight products go live on The Graph Network.

After launching the decentralized network in Dec 2020 and migrating the first subgraphs in April 2021, several products, including Audius, DODO, Livepeer, and UMA, are now live on the network indexers are earning fees for processing query requests. The team aims to run more subgraphs and dapps on the network and build a truly decentralized web.

About ClayStack:

ClayStack is a decentralized liquid staking protocol that enables you to earn staking rewards while keeping your assets liquid. Without any lockups.

Get the latest updates!

Learn more about ClayStack, interact with our team, engage in community discussions, and share your valuable feedback.

- Telegram: https://t.me/claystack

- Twitter: https://twitter.com/ClayStack_HQ

- Website: https://claystack.com/

- Announcements: https://t.me/claystackchannel

- Alpha program: https://claystack.com/contact/alpha_tester